Customer churn is one the most crucial factors for calculating and predicting growth in SaaS companies which offer recurring services. In fact, anytime you ask, someone will tell you about how important it is to calculate customer churn, along with giving you a complex list of calculations which you must execute to measure growth correctly.

To save you from the unnecessary trouble, we have listed out and explained the only 3 churn calculations you need to understand. We’ve also explained how you can use these to measure the growth of your SaaS company. Let’s dive in.

What Is Customer Churn?

To put in the simplest terms, customer churn or attrition means when a customer calls it quits – or cancels their subscription with your company.

Customer churn rate (also called attrition rate) is the rate at which customers churn occurs over time – and it is a negative factor. Meaning that the higher your customer churn rate is, the worse it is for your growth.

Customer churn is a normal thing – it is natural as your business grows and you get more subscribers, some of them will leave. The catch here is that churn grows as your subscribers grow – so you have to align the growth of your company to beat these churn rates.

Calculating Churn: The Most Important Thing

When calculating churn, there a few factors which you have to keep in mind.

The first thing is that churn is relative to the time it’s calculated over. So if you’re calculating the monthly churn rate, it will be the number of cancelled subscriptions in the month. If you’re calculating it annually, it will be subscriptions cancelled over the year.

It makes sense to calculate the churns based on the average time period of your subscription. Let us now talk about the various types of Churn Calculations:

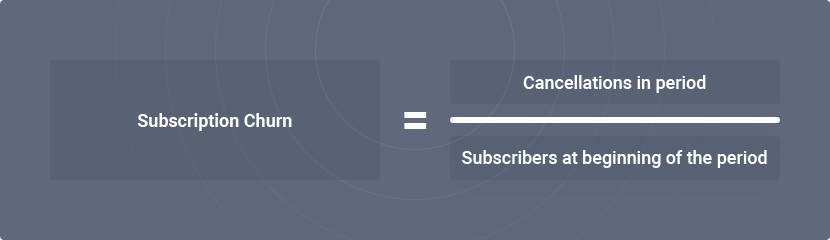

Subscriber/Customer Churn Rate

The most commonly calculated churn – subscriber churn rate simply defines the percentage of customers you lost in a given period of time. It can be calculated as

It is the simplest churn calculation and gives you an idea of the average cancellations you have. The important thing to be noted in this churn calculation is that we do not consider the new subscriptions that have been added in this time period.

For example, you have 100 subscribers and you lose 40 in one month while adding 20 new ones. So your subscription churn for that month would be:

Subscriber Churn = 40/100 = 40%

The 20 new subscriptions are not taken into account. We divide by the number that was at the beginning of the period.

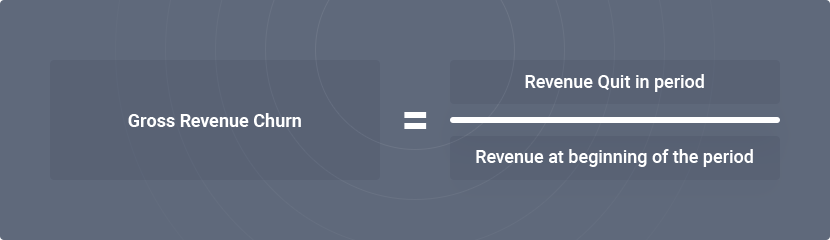

Gross Revenue Churn Rate

Similar to subscriber churn, Revenue Churn Rate defines the percentage of revenue in you lose due to cancellations in a given a period of time. It can be calculated as

Again, similar to customer churn, we do not consider the revenue added due to new subscriptions during the time period into account while calculating the churn.

For example, if you have revenue of $10,000 at the beginning of the year. You lost subscriptions worth $1000 in the year and added about $2000 worth. Your revenue churn for the year

Revenue Churn = 1000/10000 = 10%

Revenue churn is usually smaller as compared to customer churn when calculated in the same time period. This is because your biggest customers are responsible for the most amount of revenue.

The smaller customers (who are usually buying smaller subscriptions), will be financially unsure and are more likely to leave in greater numbers, hence increasing the subscriber churn numbers.

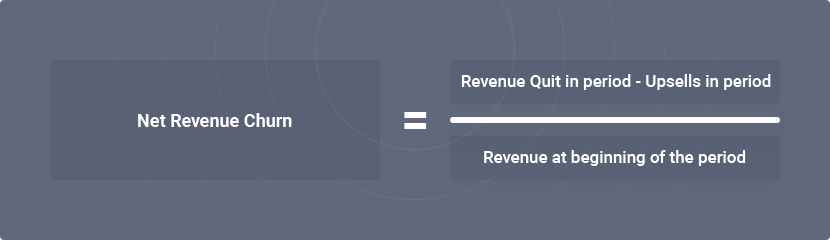

Net Revenue Churn Rate

The most accurate, and probably the most critical churn rate calculation – the net revenue churn rate calculates the percentage of revenue you have lost from existing customers in a defined period. Like gross revenue churn, it uses the revenue lost from cancellations, but it also takes into account the revenue earned from customer upsells during that period.

Revenue from upsells means the additional revenue from existing customers upgrading their subscriptions/ opting in for new features of your product.

This churn is much more accurate, as it takes into account the additional revenue that comes from the existing customers during that time.

Net Revenue rate can be slightly confusing to understand.

If the rate is positive, it means the revenue quit is greater than the revenue earned from upsells during that period, so a greater amount of new subscriptions is required after every time period.

If the rate is close to 0, it means that the revenue loss and upsells are cancelling each other, and the additional revenue will come only from new subscriptions.

If this rate is negative, it actually is good for the company, as the revenue from the upsells in the time period is more than the losses from cancellations. This indicates that the company’s revenue would increase even if there were no sales in the time period.

Advice for Churn Rates

Customer churn harms an organization in multiple ways. Apart from the recurring revenue (RR) loss that the organization faces – they might not have recovered the money they spent on customer acquisition in the first place. This results in a net loss through the lifetime of the customer.

Hence as an organization, your goals should include achieving negative churn rates. Achieving these and keeping up with your growth goals can be hard. The best way to achieve negative churn rates is to proactively manage customer retention.

Customers mostly cancel their subscriptions because they have stopped getting value from the services. Customer Retention refers to the set of practices which analyse, at every step that the customer gets value.

It also includes analysing behaviour which indicates that the customer is losing interest and has started feeling they don’t get value anymore. In this regard – you can use customer success software like Custify.

Custify gathers all data essential to customer success automatically and presents all relevant customer success KPIs and client interactions to you. You can respond in the best way at the right time. Your customers receive valuable help when they need it most, and you’re thus driving customer loyalty, which itself includes retention.

Conclusion

So this is it – the three simplest and most vital churn calculations you need to know to get an effective picture of your organisation’s growth. It is important to stick to these basic formulas and not get stuck up in more complicated calculations. Keep it simple and clear.

Feel free to let us know your thoughts!